verde solution

Новичок форума

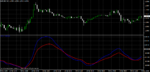

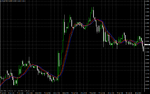

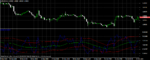

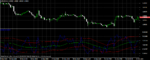

Dynamic Zone RSI VertexFX Indicator

The Dynamic Zone RSI is a powerful VertexFX client-side indicator based on the Relative Strength Index (RSI) and Bollinger Bands used to identify market swings.

The Relative Strength Index (RSI) indicator is useful in identifying the current trend, and its strength. When the RSI bottoms out and starts to rise it implies a bullish trend. On the contrary, when the RSI tops out and starts to fall it implies a bearish trend. The Bollinger Bands provides a trading range for the price based on standard deviation. The Dynamic Zone RSI indicator combines these two indicators to provide a composite overview of the trend.

In the first step, the RSI is calculated based on the RSI period. In the second step, the Bollinger Bands of this RSI are calculated to generate the center, upper and lower RSI zones. The range between the upper and lower band is called the Dynamic Zone.

When the RSI is below the lower band, the trend is bearish. When it turns sideways o r bottoms out, the trend now becomes neutral. When the RSI crosses above the lower band from below it is considered the start of a bullish trend.

r bottoms out, the trend now becomes neutral. When the RSI crosses above the lower band from below it is considered the start of a bullish trend.

Likewise, when the RSI is above the upper band, the trend is bullish. When it turns sideways or tops out, the trend now becomes neutral. When the RSI crosses below the upper band from above it is considered the start of a bearish trend.

Unlike RSI which provides fixed levels (eg 30/70) for entry and exit, Dynamic Zone RSI adapts the trading levels based on the price and the characteristics.

BUY / EXIT SHORT - Enter LONG (or exit SHORT) when the Dynamic Zone RSI (blue) crosses above the lower band from below.

SHORT / EXIT LONG - Enter SHORT (or exit LONG) when the Dynamic Zone RSI (blue) crosses below the upper band from above.

The Dynamic Zone RSI is a powerful VertexFX client-side indicator based on the Relative Strength Index (RSI) and Bollinger Bands used to identify market swings.

The Relative Strength Index (RSI) indicator is useful in identifying the current trend, and its strength. When the RSI bottoms out and starts to rise it implies a bullish trend. On the contrary, when the RSI tops out and starts to fall it implies a bearish trend. The Bollinger Bands provides a trading range for the price based on standard deviation. The Dynamic Zone RSI indicator combines these two indicators to provide a composite overview of the trend.

In the first step, the RSI is calculated based on the RSI period. In the second step, the Bollinger Bands of this RSI are calculated to generate the center, upper and lower RSI zones. The range between the upper and lower band is called the Dynamic Zone.

When the RSI is below the lower band, the trend is bearish. When it turns sideways o

r bottoms out, the trend now becomes neutral. When the RSI crosses above the lower band from below it is considered the start of a bullish trend.

r bottoms out, the trend now becomes neutral. When the RSI crosses above the lower band from below it is considered the start of a bullish trend.Likewise, when the RSI is above the upper band, the trend is bullish. When it turns sideways or tops out, the trend now becomes neutral. When the RSI crosses below the upper band from above it is considered the start of a bearish trend.

Unlike RSI which provides fixed levels (eg 30/70) for entry and exit, Dynamic Zone RSI adapts the trading levels based on the price and the characteristics.

BUY / EXIT SHORT - Enter LONG (or exit SHORT) when the Dynamic Zone RSI (blue) crosses above the lower band from below.

SHORT / EXIT LONG - Enter SHORT (or exit LONG) when the Dynamic Zone RSI (blue) crosses below the upper band from above.

Вложения

Последнее редактирование модератором: