ishitaraorfx

Интересующийся

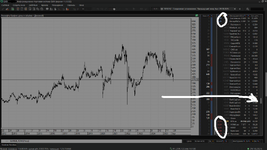

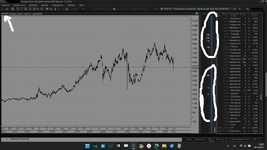

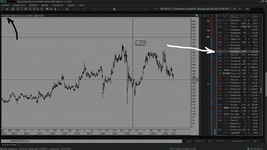

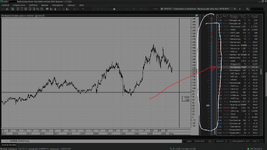

That's a fair observation. The Russian stock market has been facing prolonged stagnation, largely due to geopolitical tensions, sanctions, and limited foreign investment. Liquidity remains low, and many institutional investors have pulled back, which dampens volatility but also curbs growth potential.The Russian stock market is currently stagnating. If the situation worsens, such as a worsening geopolitical situation or a decline in oil prices, a further decline of 10-25% is expected in the MOEX/RTS index from current levels. Stagflation is depleting reserves, exacerbating the decline.

Trump stated:

"I was unhappy with India buying oil from Russia. And Modi assured me today that they will not buy oil from Russia. This is a big step. Now we need China to do the same."

The outlook is bleak.

Посмотреть вложение 577317

From a forex perspective, this stagnation can influence ruble dynamics. A sluggish equity market often reflects broader economic uncertainty, which may weigh on the currency unless supported by strong commodity exports or central bank interventions.

It'll be interesting to watch how domestic policy shifts or global commodity trends (especially oil and gas) might impact both the stock market and the ruble going forward.