Вы используете устаревший браузер. Этот и другие сайты могут отображаться в нем неправильно.

Необходимо обновить браузер или попробовать использовать другой.

Необходимо обновить браузер или попробовать использовать другой.

Сборник систем XARD777.

- Автор темы rambul

- Дата начала

FxMen

VIP-участник

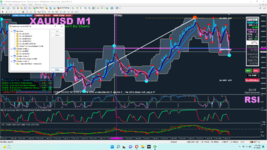

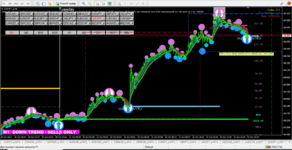

UPDATE: XU v38 Setup

As promised here is the updated version of Xard Universe.

You can change the settings in the menu to suit your own trading style.

However, the default setting is the one that I use myself when trading.

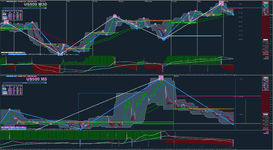

If you can split your trading screen into two horizontal screens you can give yourself a better view of the roadmap ahead.

The top screen can be set to show Daily or H4 overview TF and the bottom screen can be your M15 or M5 entry screen.

This makes trading all that easier and allows you plenty of advanced time to create your trading plays for each trading day.

Remember - Trading is not rocket science, use your common sense and watch the support/resistance semafors.

Trading should be fun, tax-free, and rewarding on many levels.

Xard777

As promised here is the updated version of Xard Universe.

You can change the settings in the menu to suit your own trading style.

However, the default setting is the one that I use myself when trading.

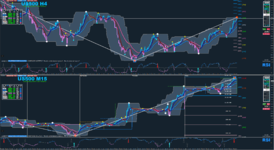

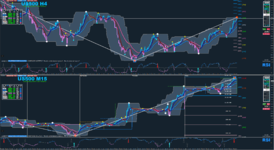

If you can split your trading screen into two horizontal screens you can give yourself a better view of the roadmap ahead.

The top screen can be set to show Daily or H4 overview TF and the bottom screen can be your M15 or M5 entry screen.

This makes trading all that easier and allows you plenty of advanced time to create your trading plays for each trading day.

Remember - Trading is not rocket science, use your common sense and watch the support/resistance semafors.

Trading should be fun, tax-free, and rewarding on many levels.

Xard777

Вложения

FxMen

VIP-участник

обновленный файл tplОБНОВЛЕНИЕ XU v46

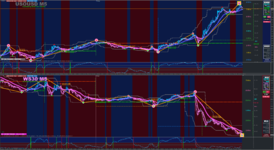

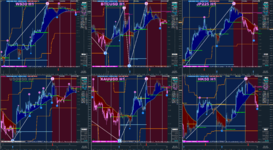

В эту версию включены четыре шаблона.

Посмотреть вложение 487199Посмотреть вложение 487200Посмотреть вложение 487201Посмотреть вложение 487202

Вложения

FxMen

VIP-участник

XU v50 Update - Out NOW!!!

We are the sum of what we do

Our actions define us, shaping our character, values, and reputation. Each decision we make and behaviour we exhibit contributes to our personal growth and development. As we go through life, it's important to be aware of the impact our actions have on ourselves, others and the world around us. When we fall short or make mistakes, it's crucial to reflect on them, learn from them, identify areas for improvement, and make necessary changes. This way, we can use our experiences to empower ourselves, become more resilient, and ultimately strive for greater success. Xard #2023

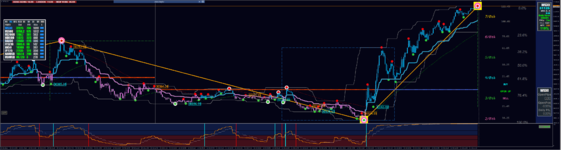

Enter the XARD UNIVERSE, where the key to success is knowledge, and that knowledge is used to unlock daily profits through intra-day trading. And let's be real, there's nothing more powerful than compounding Pip$$$. Introducing the latest XU v50 Edition, equipped with the best tools to make you the master of your own destiny.

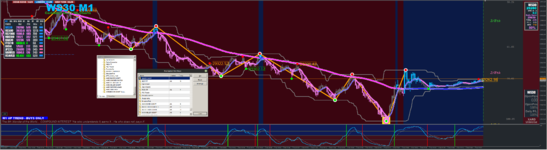

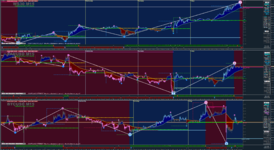

Revised version based on trading the Dow Jones Index...

The Xard #2023 Day Trading Plan is designed to efficiently execute trades using a combination of zigzag patterns and moving average crossovers to identify potential intra-day turning points and confirm them before entering trades. Additional filters and stop-loss orders are used to manage risk and limit potential losses if the market moves against the trade. The goal of this plan is to streamline the trade execution process while effectively managing risk.

Here is a step-by-step guide on how this strategy might play out:

1. Check the News reader: Look for major news events that can impact markets and avoid being caught off guard by unexpected market news.

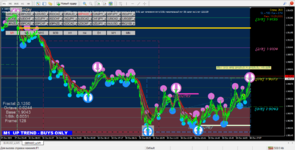

2. Identify a Zigzag pattern: Look for the Blue Zigzag line in the price action of the security. This pattern may indicate that a turning point or reversal is approaching. However, it is important to wait for confirmation from other technical indicators before entering a trade based on this pattern.

3. WAIT!!! for confirmation before entering a trade: Once the Zigzag pattern has completed, look for confirmation from multiple technical indicators. This may include the 9-EMA moving average crossing the 36-EMA trend line and the RSI crossing the mid level in the direction of your anticipated trade. Having multiple confirmations can increase the likelihood of a successful trade.

4. Additional Filters: If the RSI is above the mid level in the sub-window, it may indicate an upward trend, and when the RSI is below the mid level, it may suggest a downward trend. Also, look for instances where price is crossing the Xard Index Entry line in conjunction with the RSI crossing the mid level filter.

5. Enter a Trade: If you see clear confirmation from multiple technical indicators that a turning point or reversal is occurring, consider entering a trade in the direction of the anticipated move. This may involve looking for instances where the zigzag pattern has formed, the RSI has crossed the mid level, and the moving average line is crossing the trend line, or where the price is crossing the Xard Index line in conjunction with the RSI crossing the mid level. Additional trades may be made after a 2nd Dot/Marker has appeared in the direction of the current trend. It is important to carefully assess the market conditions and the potential risk before making a trade.

6. Set a Stop-loss order: To manage risk, set a virtual/manual stop-loss order at the previous level of the zigzag. This will limit your potential loss if the price moves against your trade.

7. Intra-day trading Exit Strategy: When an intra-day trade results in a gain of +100 pips, traders may choose to take their profits at this point. This can be a good opportunity to re-assess the market conditions and consider re-entering the trade if there are signs of continuation. It is important to have multiple exit strategies in your trading plan and to make decisions based on your own analysis and risk tolerance. Some traders may choose to stay in the trade and add to their position if the market continues in their favour, while others may prefer to take profits and exit the trade. It is important to consider your personal risk tolerance and the market conditions when deciding on an exit strategy.

8. Trading order out of chaos: By identifying patterns and using technical analysis, we can create order out of chaos and make informed trades. However, there may be times when the market is unpredictable or the patterns we are observing are disrupted. In these situations, it can be helpful to wait for the market to return to a more orderly state before entering a trade. This can involve waiting for certain technical indicators to confirm a turning point or for the market to stabilize after a news event or other unexpected event. By being patient and waiting for the right opportunities, we can increase our chances of success in trading.

Having a well-defined trading plan can help you to trade with confidence and allow you to make more informed decisions about when to enter and exit trades.

It might also be helpful to include a step to review your trades and assess your performance. This could involve analysing your trade logs, tracking your win-loss ratio, and identifying areas for improvement in your trading plan.

These steps serve as the foundation for you to construct your own path to success, feel free to customize and make it your own.

XARD777

PAY IT FORWARD

The greatest Gifts in Life are FREE

We are the sum of what we do

Our actions define us, shaping our character, values, and reputation. Each decision we make and behaviour we exhibit contributes to our personal growth and development. As we go through life, it's important to be aware of the impact our actions have on ourselves, others and the world around us. When we fall short or make mistakes, it's crucial to reflect on them, learn from them, identify areas for improvement, and make necessary changes. This way, we can use our experiences to empower ourselves, become more resilient, and ultimately strive for greater success. Xard #2023

Enter the XARD UNIVERSE, where the key to success is knowledge, and that knowledge is used to unlock daily profits through intra-day trading. And let's be real, there's nothing more powerful than compounding Pip$$$. Introducing the latest XU v50 Edition, equipped with the best tools to make you the master of your own destiny.

Revised version based on trading the Dow Jones Index...

The Xard #2023 Day Trading Plan is designed to efficiently execute trades using a combination of zigzag patterns and moving average crossovers to identify potential intra-day turning points and confirm them before entering trades. Additional filters and stop-loss orders are used to manage risk and limit potential losses if the market moves against the trade. The goal of this plan is to streamline the trade execution process while effectively managing risk.

Here is a step-by-step guide on how this strategy might play out:

1. Check the News reader: Look for major news events that can impact markets and avoid being caught off guard by unexpected market news.

2. Identify a Zigzag pattern: Look for the Blue Zigzag line in the price action of the security. This pattern may indicate that a turning point or reversal is approaching. However, it is important to wait for confirmation from other technical indicators before entering a trade based on this pattern.

3. WAIT!!! for confirmation before entering a trade: Once the Zigzag pattern has completed, look for confirmation from multiple technical indicators. This may include the 9-EMA moving average crossing the 36-EMA trend line and the RSI crossing the mid level in the direction of your anticipated trade. Having multiple confirmations can increase the likelihood of a successful trade.

4. Additional Filters: If the RSI is above the mid level in the sub-window, it may indicate an upward trend, and when the RSI is below the mid level, it may suggest a downward trend. Also, look for instances where price is crossing the Xard Index Entry line in conjunction with the RSI crossing the mid level filter.

5. Enter a Trade: If you see clear confirmation from multiple technical indicators that a turning point or reversal is occurring, consider entering a trade in the direction of the anticipated move. This may involve looking for instances where the zigzag pattern has formed, the RSI has crossed the mid level, and the moving average line is crossing the trend line, or where the price is crossing the Xard Index line in conjunction with the RSI crossing the mid level. Additional trades may be made after a 2nd Dot/Marker has appeared in the direction of the current trend. It is important to carefully assess the market conditions and the potential risk before making a trade.

6. Set a Stop-loss order: To manage risk, set a virtual/manual stop-loss order at the previous level of the zigzag. This will limit your potential loss if the price moves against your trade.

7. Intra-day trading Exit Strategy: When an intra-day trade results in a gain of +100 pips, traders may choose to take their profits at this point. This can be a good opportunity to re-assess the market conditions and consider re-entering the trade if there are signs of continuation. It is important to have multiple exit strategies in your trading plan and to make decisions based on your own analysis and risk tolerance. Some traders may choose to stay in the trade and add to their position if the market continues in their favour, while others may prefer to take profits and exit the trade. It is important to consider your personal risk tolerance and the market conditions when deciding on an exit strategy.

8. Trading order out of chaos: By identifying patterns and using technical analysis, we can create order out of chaos and make informed trades. However, there may be times when the market is unpredictable or the patterns we are observing are disrupted. In these situations, it can be helpful to wait for the market to return to a more orderly state before entering a trade. This can involve waiting for certain technical indicators to confirm a turning point or for the market to stabilize after a news event or other unexpected event. By being patient and waiting for the right opportunities, we can increase our chances of success in trading.

Having a well-defined trading plan can help you to trade with confidence and allow you to make more informed decisions about when to enter and exit trades.

It might also be helpful to include a step to review your trades and assess your performance. This could involve analysing your trade logs, tracking your win-loss ratio, and identifying areas for improvement in your trading plan.

These steps serve as the foundation for you to construct your own path to success, feel free to customize and make it your own.

XARD777

PAY IT FORWARD

The greatest Gifts in Life are FREE

Вложения

rkgodsend7

Активный участник

Хард очень любит мишуры понавесить на весь график. Главное пожирнее и погуще))) Толку то правда ноль. В тренде и так можно хоть на одной машке торговать.Полныи пипец. Поставил на м5 и на 1ч. Даже на 1ч невозможно крутить. Полностю на экране и всякого слишком много.натреть не даст .блин!

Skyrider60

Активный участник

От этой цветомузыки в глазах рябит. Глупости это все. Набор рисовалок.

rkgodsend7

Активный участник

согласен . полная шляпа от набора индикаторов. рисуют все и пытаются в тренд войти. так это можно и на двух машках сделать если повезет.От этой цветомузыки в глазах рябит. Глупости это все. Набор рисовалок.