MDunleavy

Активный участник

A noteworthy improvement in Reserve Bank of New Zealand interest rate forecasts has coincided with a fairly sharp New Zealand Dollar recovery. Indeed, the NZD trades at fresh post-float highs, and relative yield expectations have likely played a part.....Detail↓

============================

Новая ссылка на программу Bull's-Eye Broker, недавно получил на почту.

-------------

Это же на SendIt

Here's the link to your file:

File expiration date: June 27, 2011

=============

Такая проблема возникла у одного приятеля с одного форума не получается настроить "бычеглазик" на русской Windows-7.

У кого русская "семёрка" если не лень протестируйте пожалуйста.

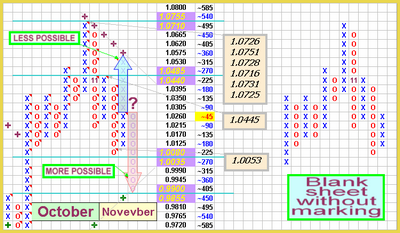

Вот это может пригодиться, может кому-то нужно вспомнить некоторые детали настроек.

Код:

http://iticsoftware.com/postimages2//201009/11Jun21.html

^^^ OR vvv

http://img192.imageshack.us/img192/8363/11jun21.pdf

^^^ OR vvv

https://docs.google.com/document/pub?id=1fqx-sUKZqF5FCzJUFRnGwz6GSactFp1SPCwlWhzix8A#id.4hss3l3l2qa1

^^^ OR vvv

A t t a c h m e n tНовая ссылка на программу Bull's-Eye Broker, недавно получил на почту.

Код:

http://www.pointandfigure.com/BEB/BEBV4.EXEЭто же на SendIt

Here's the link to your file:

Код:

https://www.yousendit.com/download/UnlBa0Zld0FxRTN2Wmc9PQ=============

Такая проблема возникла у одного приятеля с одного форума не получается настроить "бычеглазик" на русской Windows-7.

У кого русская "семёрка" если не лень протестируйте пожалуйста.

Вот это может пригодиться, может кому-то нужно вспомнить некоторые детали настроек.

Код:

https://docs.google.com/document/pub?id=1uBAFfHF3UHk6VM-IoQ9FmfYfDCbHzy5En6UDMtJJH5A

https://docs.google.com/document/pub?id=1C8WRBtWJmULGWpS7myD5_LY0fIGbb7XjKBgtkClWA_U